The government has announced GST in India on July 01, 2017. This is an Indirect Tax system and it is the centralised tax in one umbrella.

Basically GST is mandatory for the businesses with annual turnover of Rs.40 lakhs and above in a financial year and those businesses with annual turnover below Rs.40 lakhs have been voluntarily registered for GST.

Offset is one of main process in GST filing which is included in the form GSTR-3B.

The payment option is available only in GSTR-3B.

GSTR-3B is called consolidated summary of Sales and Purchase.

GSTR-3B has the following steps:

- Form section

- Save

- Create Challan

- Offset process

- Submit

- File

Now, let us see the Offset process. This includes payment and ledger offset.

After saving the return, navigate to Offset page for closing the current month’s sales and purchase.

Offset Options are as mentioned below:

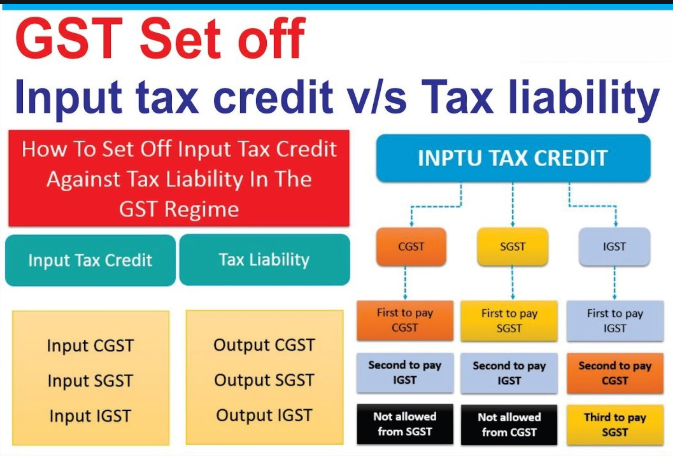

Taxpayers should first use the ITC available from IGST to pay in the tax payable in IGST. The ITC balance after this can then be used towards paying CGST, SGST.

These are the steps followed in CGST and SGST.

For example, Sakthi Engineers has an IGST credit of Rs.50,000 (Rs.15,000 + Rs.15,000 + Rs. 20,000), and tax liabilities of IGST 20,000, CGST 10,000 and SGST 15,000.

According to the tax offsetting rules under GST, IGST credit needs to be used first to offset IGST tax liability.

The IGST credit left out can be used against CGST liability, after which it against SGST liability.

So, offset rules is applied automatically in the GST Portal but it is always good to know about ITC utilization for accounting purpose and to gain GST knowledge.