Introduction:

E Way bill is an electronic bill for the movement of goods and it is generated by the common portal https://ewaybillgst.gov.in. E-way bill is applicable to the movements of goods in both inter and intra state. When the goods of value is above Rs.50000, the E-way bill should be created. The physical copy of Eway bill needs to be carried by the transporters when the goods move and it should contain goods details, recipient details, consignor and transporter details. The e-way bill was rolled out nationwide on 1st April 2018.

When should an E-way Bill ​be generated?

- When the transfer sales is above Rs.50000 worth goods from the registered person

- When we take inward purchases above Rs.50000 worth goods from the registered person

- When a damage or a return happens (Sales or Purchase return)

GST E-Way Bill Format:

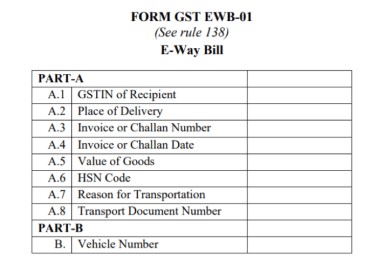

E-Way Bill Format:

The bill will be created by 2 parts – Part A and Part B.

Part A of the form is to collect the details of the consignment. It is usually about the invoice.

- GSTIN of Recipient

- Place of Delivery

- Invoice or Challan Number

- Value of Goods

- HSN Code

- Transport Document Number: One needs to enter the Goods Receipt Number/ Railway Receipt Number/ Airway Bill Number/ Bill of Loading Number.

In Part B of this form, one needs to fill in the vehicle number of the transported goods. The transporter will complete this information in the common portal.

What is the validity of the E-Way Bill?

Less than 100 KM: 1 Day

Every 100 Km or part thereof thereafter – 1 additional day

The validity period will be counted from the time of generation of the E-Way Bill. It may be extended by the Government for some reasons or category of goods, as specified in the notification issued in this regard.

Who should generate the E-Way Bill?

- When goods are transported by a registered person, acting as a consignee or consignor in his own vehicle, hired vehicle, railways, by air or by vessel, the supplier.

- When the goods are handed over to a transporter, the E-Way Bill should be generated by the transporter. In this case, the registered person should give the details of the goods in a common portal.

- In case of inward supplies from an unregistered person, either the recipient of supply or the transporter should generate the E-Way Bill.

When an E-way bill is Not Required?

- The mode of transport is non-motor vehicle

- Goods transported from Customs port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

Very useful blog about E-way bill.I can understand why E-way bill mandatory…Same every travel agents and business people should be know that..