GST Reconciliation of Data Mismatch

Classification of transactions

Every GST registered business has an outward supply tax liability, inward supply input tax credit and tax cash transactions. These three types of transactions are grouped as:

All three ledgers need to be reconciled before finalising the monthly GST reports ready for filing. Any exemption will lead to reversal of tax, penalty, interest etc.

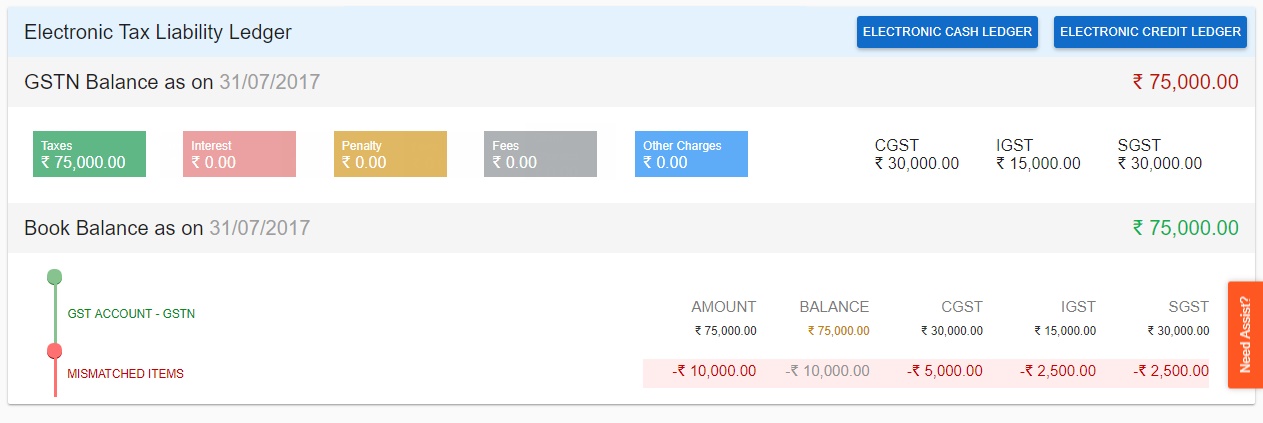

Electronic tax liability ledger

All GST data submitted from the seller/service provider will be available on 16th for identification of mismatch entries. Any supplier’s GST data misrepresented by the business tax payer as a buyer could create a situation where the supplier is unable to complete the GST payments and or finalize the GST report as each and every mismatched tax invoices need to be scrutinized at the sourced level and require the counter party to correct the data.

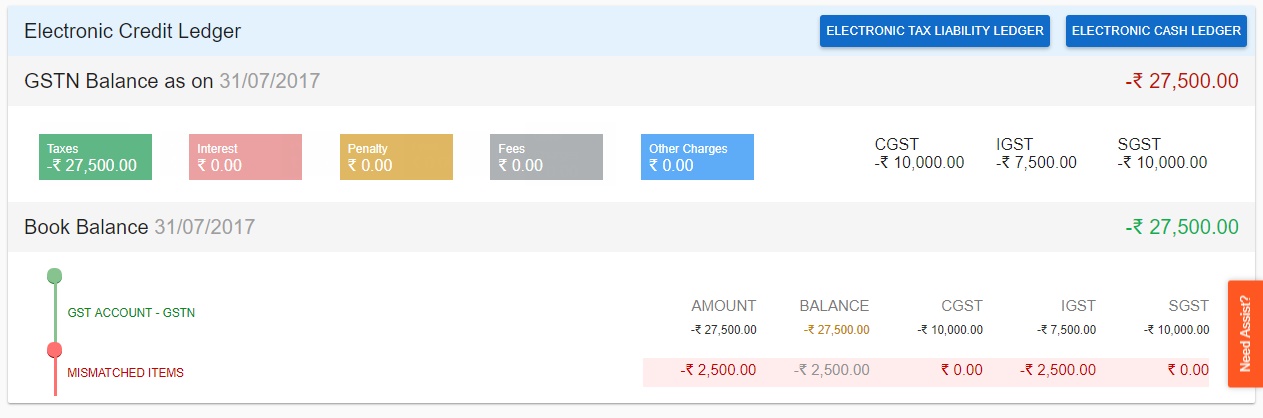

Electronic input tax credit ledger

Similar to Electronic tax liability ledger, business tax payer should check his books to correct the data as much as possible and interact with the counter party to match the data. As data are managed digitally, any correction at one end will automatically carried over to other concerned parties and the data will be auto matched.

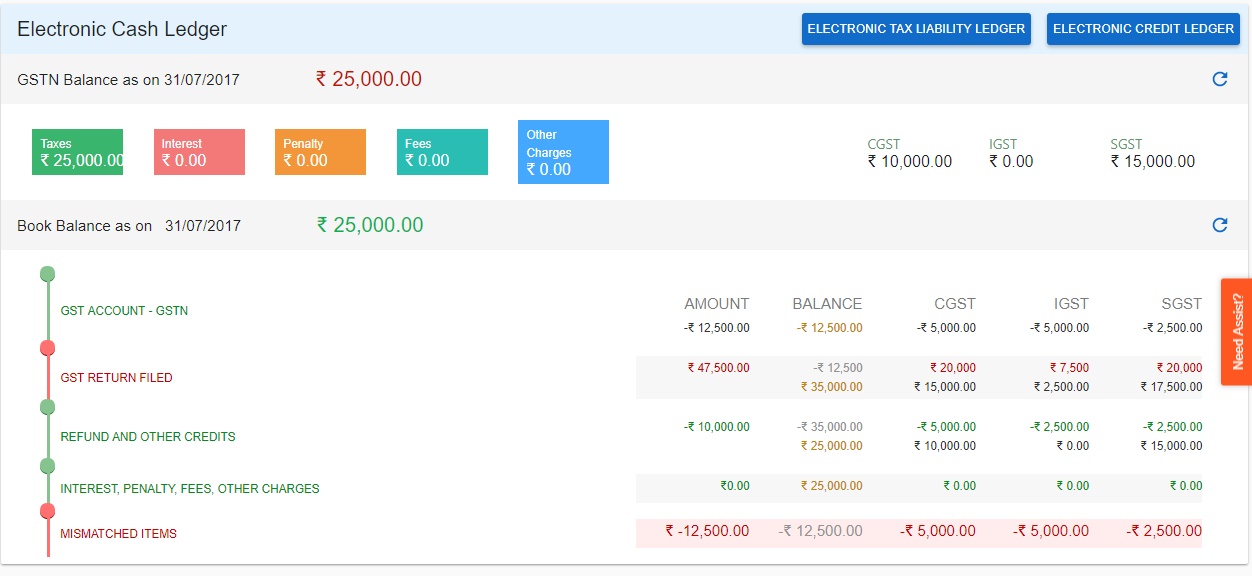

Electronic cash ledger